Equatoria Teak Company – The journey to becoming investment ready

In 2019 SNV started to work with Equatoria Teak Company (ETC) in South Sudan to help to make their business investment ready for green financing.

SNV supported ETC under the Dutch Fund for Climate and Development (DFCD) by extending grant funding of USD 330,000 (equivalent to 300,000 Euros) and technical assistance. This innovative programme helps to generate private sector investment for climate adaptation and mitigation projects in developing countries, helping increase vulnerable communities' climate resilience.

SNV assisted ETC with their business plans by providing advice and guidance, helping to prepare or "graduate' their business for investment.

The story of ETC

In 2019, The Dutch Bank (FMO) introduced Equatoria Teak Company (ETC) with teak plantations in South Sudan to SNV for possible support under the Dutch Fund for Climate and Development project (DFCD).

In August 2021, ETC entered into a framework agreement with SNV for a grant funding of USD 330,000 (equivalent to 300,000 Euros) and technical assistance for the development of a business investment proposal for project preparation, de-risking, and enhancement in investment proposal for the expansion of its teak plantation and out-grower agroforestry systems for coffee, vanilla, groundnuts, and sesame value chains in South Sudan. This investment directly targets climate change action and improving the livelihoods of local communities in Western Equatoria state in South Sudan. The grant funding agreement marked the first funding approval in South Sudan. It remains the benchmark for a business proposition that aims to generate social and commercial benefits for the community.

Purpose of funding

The funds were primarily used to help grow the company's activities in the region, specifically to; undertake market and value chain studies for coffee, sesame and groundnuts, teak, and vanilla plantations, intercropping design and planning for optimum yields and crop quality. Environmental, Social and Governance (ESG) Risk Assessment to ensure best-practice mechanisms are built in for resilience and sustainability.

'The ESG assessment included security risk, a gender and social inclusion assessment, and covered the cost for multi-stakeholder engagement in readiness for Forest Stewardship Council (FSC) Certification and Carbon finance markets', Ed Stiles, one of the company directors, said.

Challenges to accessing green finance in Africa

The quest for long-term financing in Africa to catalyse Small and Medium Entrepreneurs to the next level remains challenging for many business owners. Even with the availability of green finance provided by few institutions on the continent, investor education remains a critical area that needs to be addressed urgently to ensure that investors are aware of new products in the climate finance space, such as resilience bonds, biodiversity credits, and debt for nature swaps.

Ed Stiles recalls the company's location is cited as a challenge by most investors, with most reluctant to come to South Sudan. 'People associate South Sudan with conflict, but the fighting is localised and 'hasn't posed an immediate threat to our business because we positively impact the community. Suppose more investors like FMO were genuinely committed to long-term growth with patient capital. In that case, there is potential for a business like ETC, working to international standards, to have more 'impact', Ed noted.

The poor infrastructure and a lack of grid power made it hard to compete with surrounding countries. This situation will only change when more investors take risks and invest in the country.

'We also battled negative perceptions of forestry projects in general despite rising global awareness of the urgent need for more trees. Trees take a long time to grow, and investors want a quick 'return'; Ed cited this as another reason that kept investors at bay.

Word of advice to other businesses looking to tap into green financing

Ed notes that companies need to be clear about the environmental and social impact their business is bound to have, underpinned by a route to profitability.

'We've operated successfully in South Sudan for over ten years. We have stayed when others have left; that proven track record is invaluable. The process is rigorous, so you must demonstrate how your business mitigates against proven risk. It's certainly not easy money; you must be crystal 'clear',' Ed concluded.

Employees receiving a training course

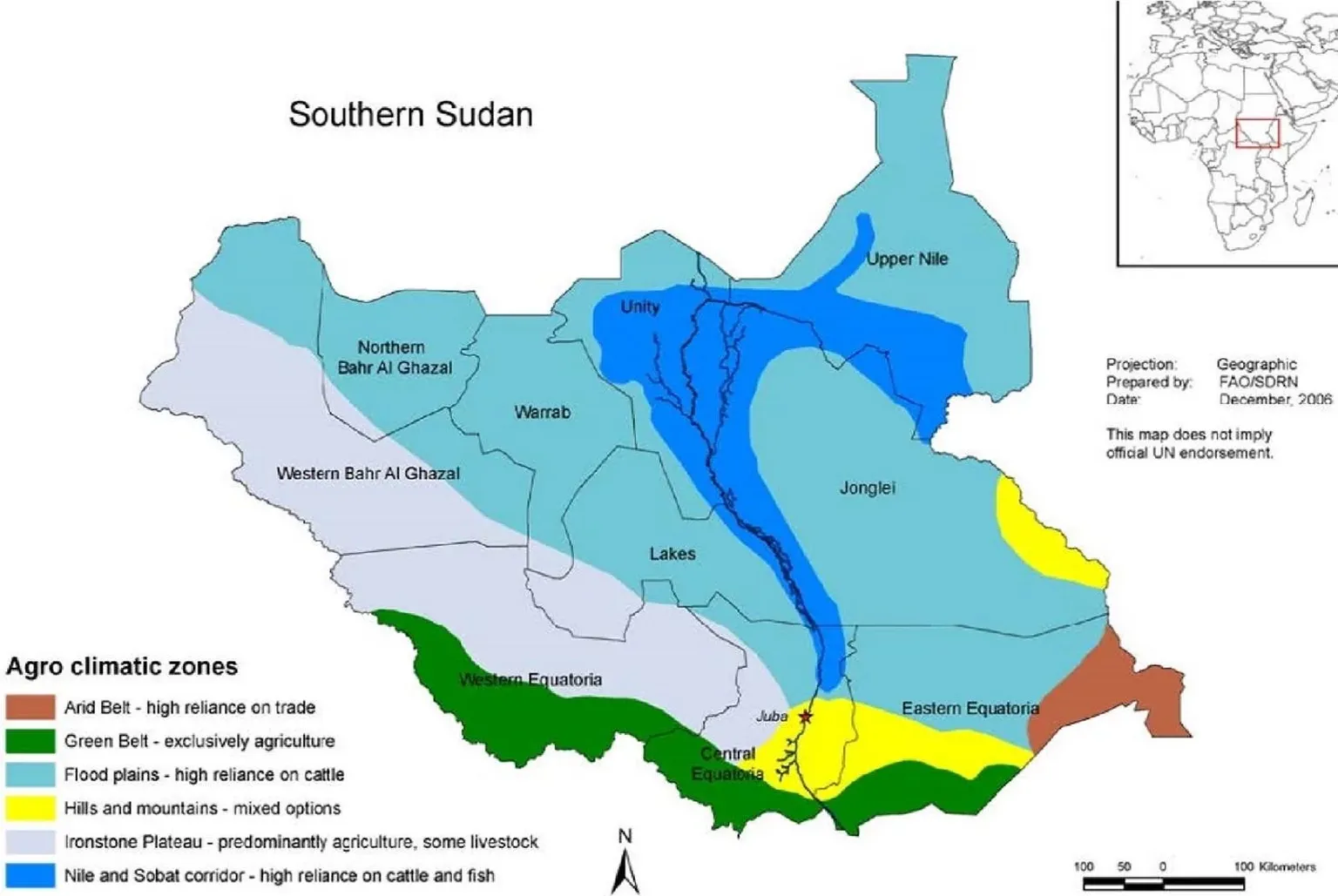

Map of Sudan

Impact of the funding

Since working with the SNV / DFCD team, ETC has started tailoring group-level standard operating procedures and policies, including preventing violence against women and girls (VAWG) across their value chain and local communities.

They also addressed the information gaps in their business case with the support they received through the origination phase.

DFCD funded three studies - a market and value chain assessment (which validated their entry into the coffee market), an Environmental and Social Assessment (that included a preliminary gender assessment) and an FSC Gap analysis - which they 'couldn't deliver on their own in a relatively short timeframe. SNV identified consultants to support them with this.

The team is recruiting an E&S manager to appropriately cascade training in addition to regularly starting shifts with toolbox talks focused on one safety training element.

ETC is already the largest private sector employer in the Western Equatoria State. With the new USD 10.5 million investment, the expected impact will add 3,000 ha of sustainable management forest lands and improve the living conditions of 1,000 out-growers and their families, providing them with diversified incomes and creating biodiverse agroforestry systems that are climate resilient.

Beyond graduation

Even as they graduate from DFCD and are presented investment to FMO, ETC is happy that their engagement with DFCD (especially the ESG component) helped them to formalise processes and safeguards that were already in place and take their gender strategy to the next level.

Due to the nature of our industry and the South Sudanese culture, 'we don't generally attract women, so ETC is targeting women and youth through Excelling in Excelsa. They are now discussing with Proparco, a French investment company, about a gender review and how to attract more women into their business at every level.

Emilia John, a mother of five, is one of the women who work at ETC. 'I want to pay my' 'children's school fees and build a concrete house. ' I'm encouraging others to plant coffee so we may have money in the future', she says.

The team hopes that 'FMO's commitment' will reassure and encourage other investors into South Sudan.

Written by Rosemary Nzuki, Regional Marketing and Communications, DFCD Programme