How can global climate finance deliver local action?

This Explainer unpacks why investing in locally led climate action is crucial, what blocks access to finance for those most affected, and how international commitments can finally deliver locally led climate action at scale.

From catastrophic floods displacing millions, to prolonged droughts causing severe food and water shortages, extreme weather events increasingly disrupt lives and livelihoods across Asia, East and West Africa and far beyond. The urgency to make climate action effective locally is growing.

Multilateral development banks recently pledged record sums—US$ 137 billion per year globally—but the key question remains: How can we ensure these resources are reaching those most vulnerable to climate shocks, and those best placed to lead adaptation?

Why invest in locally led climate action?

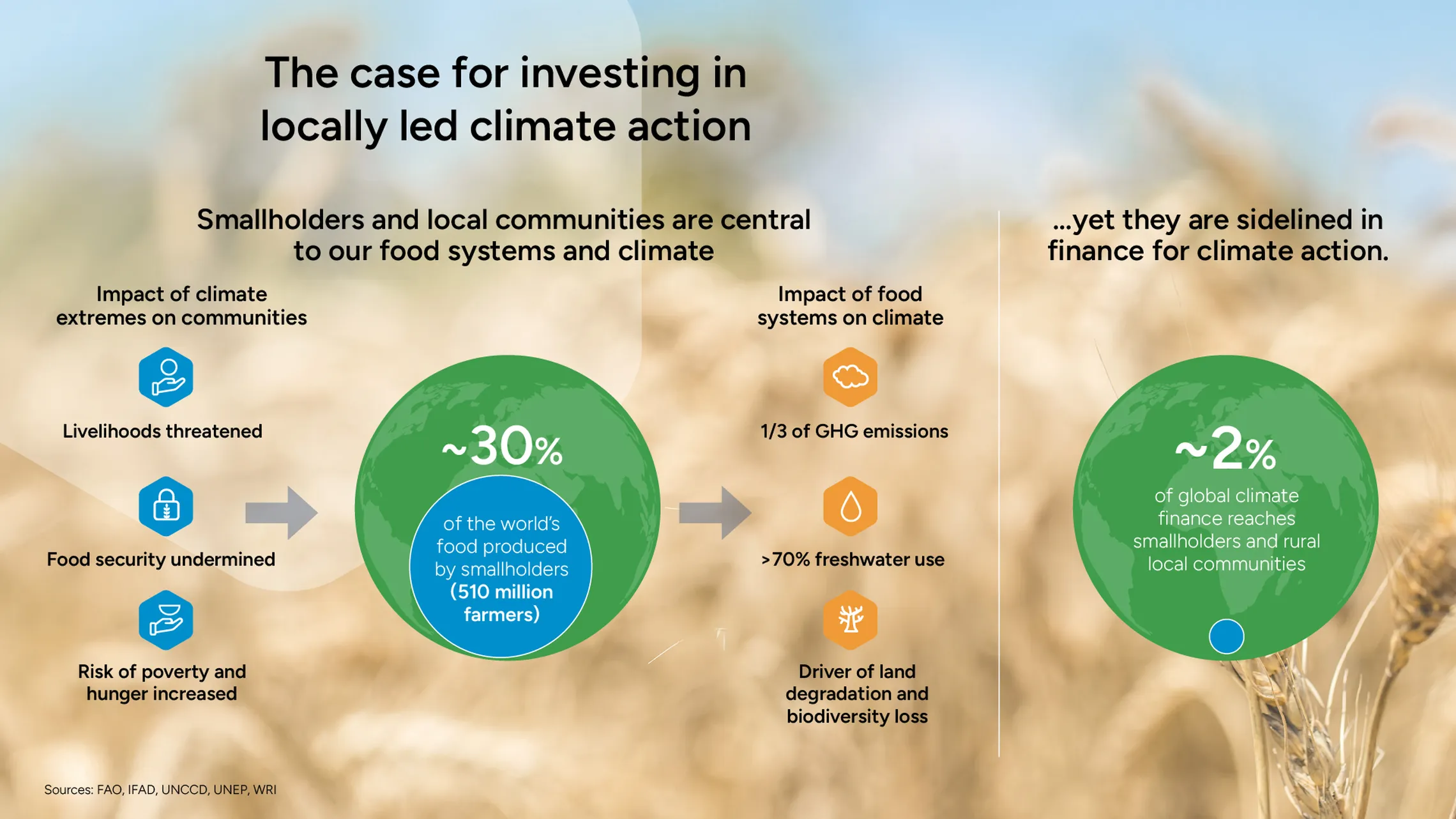

Locally led climate action matters because smallholder farmers, pastoralists and other local actors, who produce a third of the world’s food and safeguard biodiversity, are key to effective climate solutions. At the same time, they currently receive less than 2% of climate finance, leaving a significant funding gap for sustainable, inclusive action.

Food systems generate about 30% of global greenhouse gas emissions. While smallholders contribute very little to this total, they are among the most affected by climate impacts—droughts, floods, and declining crop productivity.

Equally, these local actors are uniquely positioned to drive solutions, stewarding generations of ecological knowledge, and already leading adaptation through climate-resilient crops and regenerative agriculture.

Around the world, investments directed to these communities have catalysed inclusive, lasting change—aligning with national priorities and strengthening locally rooted approaches to resilience. Examples include sustainable mangrove aquaculture in Vietnam and clean-energy-powered farming in East Africa.

Beyond the moral imperative to support local adaptation, the economic case is equally compelling. Approximately US$ 44 trillion in global value depends on nature’s services, from pollination to clean water, while the annual financing gap remains vast: US$ 600–800 billion.

Another stark imbalance: global economic and financial systems still channel about US$ 7 trillion into biodiversity-harming activities, while only around US$ 200 billion supports nature restoration and protection.

Closing this gap requires not only more funding, but empowering the leadership of smallholder farmers, women entrepreneurs, youth and Indigenous Peoples—those with the greatest stake and expertise in stewarding nature.

When support does reach these local groups, its impacts extend far beyond the here and now. According to recent data from the World Resources Institute, climate adaptation investments can deliver substantial long-term returns, from stronger value chains to regenerated ecosystems, attracting further investment and advancing broader sustainable development goals.

For example, support from the Dutch Fund for Climate and Development (DFCD) has mobilised EUR 57 million in follow-on investments for climate-smart farming across multiple countries, driving change at scale.

Why is so little climate finance reaching smallholders and other local actors?

Barriers to climate finance are complex, shaped by perception, high risk, fragmented ecosystems, varying determinants for low investment demand, limited creditworthiness, and small deal sizes. Investors frequently view ‘frontier’ markets as high-risk due to limited records or governance. Local enterprises often face a ‘missing middle’ dilemma: too large for microfinance, too small for mainstream investment. High transaction costs deter investors from seeking and evaluating dispersed community projecs.

Measuring adaptation is harder than mitigation. While emissions reductions are tangible, resilience outcomes are less quantifiable and thus undervalued. Bureaucratic obstacles—extensive paperwork, eligibility barriers, and investors prioritising short-term returns—often exclude communities from funding.

Addressing these constraints requires reimagining how capital moves and investing in systems that are flexible, locally embedded and supportive of grassroots innovation. Solutions depend on crafting finance models that are rooted within and strengthen local institutions, and designing inclusive and cross-sector approaches.

How can global finance deliver impact across regions?

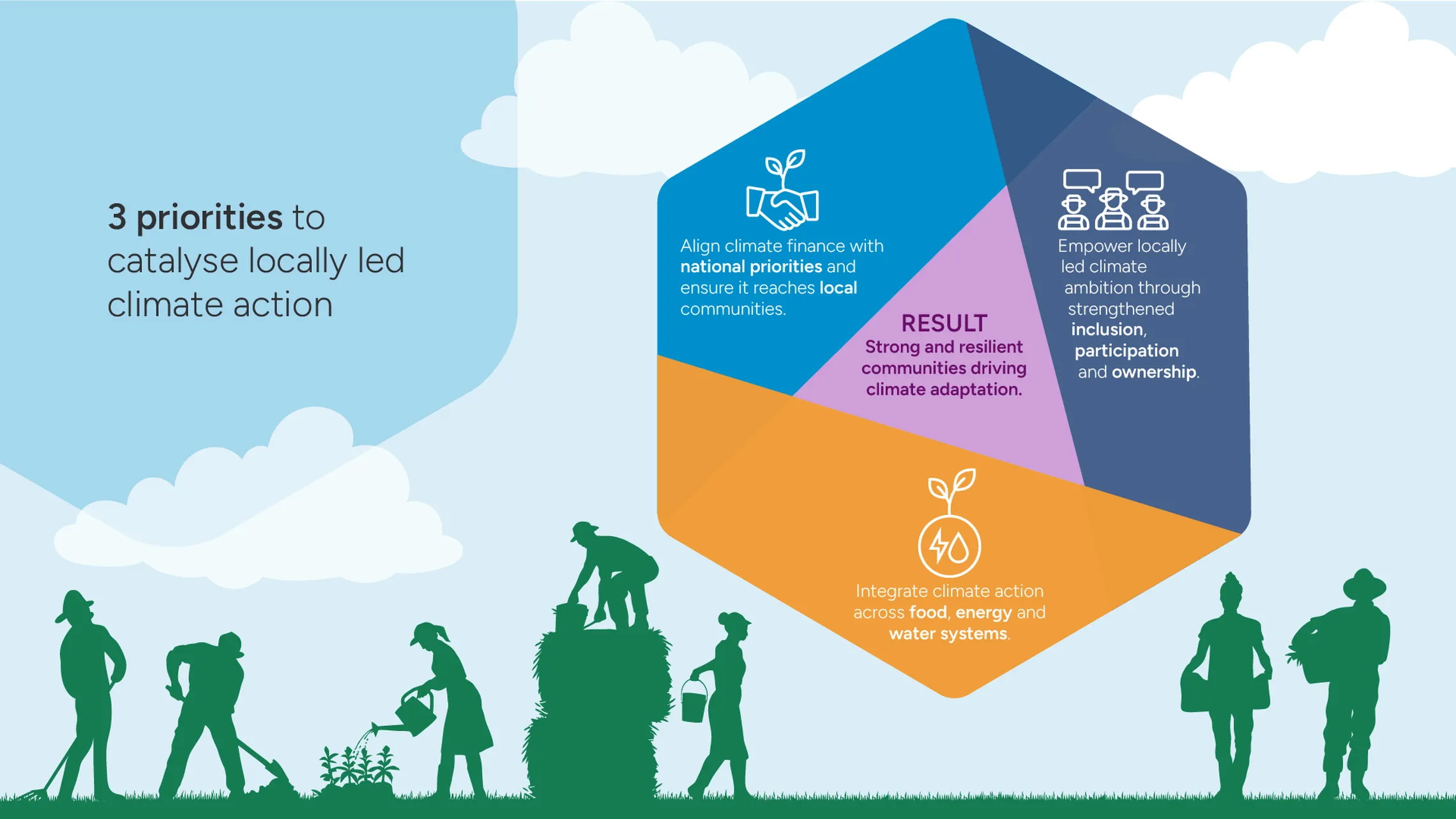

To deliver just and lasting solutions, global climate finance must be reimagined: becoming to easier to access, and supporting integrated and locally owned approaches.

First, structuring climate finance for easier access means aligning with local and national priorities, creating enabling policy environments, and building community capacity to design viable projects. Innovative instruments like blended finance, first-loss guarantees, and results-based financing can mitigate risk and attract private investment

A case in point: Camimex, a leading shrimp producer in Vietnam’s Mekong Delta. With SNV’s technical support and de-risking through DFCD's Origination Facility, the company is restoring 16,500 hectares of mangroves, sequestering 10 million tonnes of CO₂, and has already secured a US$ 15 million loan for sustainable aquaculture from FMO, the Dutch entrepreneurial development bank. International finance and local ownership combine to drive environmental restoration and economic opportunity.

In East Africa, global backing from partnerships like CRAFT have supported hundreds of thousands of farmers to lead climate-smart practices, strengthen cooperatives, and boost incomes.

Second, supporting projects that integrate food, water, and energy systems leads to more sustainable outcomes. Reframing rural development with an integrated approach, such as linking clean energy to climate-resilient agriculture and water management, helps smallholder farmers scale regenerative practices, improve yields and create jobs.

In East Africa, smallholders harness renewable energy for irrigation and processing through the SEFFA project funded by the IKEA Foundation and EnDev. Meanwhile, rural communities around the world are using biodigesters to build resilient livelihoods and reduce emissions, working across food, energy, water and sanitation.

Third, climate finance must be inclusive and support local ownership. Women, youth, Indigenous Peoples, and marginalised groups need the opportunity to lead on adaptation and mitigation. Equity and inclusion strengthen outcomes and ensure benefits are broadly shared.

In the Sahel, the Pro-ARIDES consortium, financed by the Dutch Ministry of Foreign Affairs, works with agro-pastoralists to plan, restore and implement climate-smart agriculture. Innovations such as climate-resilient forage production are spearheaded by local champions—often with ripple effects across communities. Meanwhile in Nepal, farmers are adopting climate-resilient WASH, supported by efforts to institutionalise gender equality and inclusive governance, in partnership with the Government of Australia’s Water for Women Fund.

Delivering such local climate action at scale requires robust partnerships at every level. Global actors must empower local leadership, provide technical assistance, and build institutional capacity so innovations can expand effectively.

How can international donors and governments deliver climate finance for local impact?

Meeting global climate finance pledges requires more than announcing sums. It demands transforming systems—aligning funding with national priorities, strengthening local institutions, and meaningfully involving communities with the multi-stakeholder support they may require. Collaborative partnerships rooted in trust and equity are key.

International governments and institutions can scale impact by streamlining bureaucracy, pursuing innovative finance models like blended finance, and critically, listening to and partnering directly with communities.

As COP30 approaches in Belém, focus should be on recognising community leadership and knowledge as vital for ecosystem restoration, job creation and building climate-resilient futures.

The promise of climate finance will be realised only when pledges turn into practice, led by local actors and backed by global support, to deliver lasting impact for people and the planet.

Locally led, globally backed

Progress on climate action means closing the gap between global commitments and local solutions that build lasting resilience.